Risk management is critical in uncertain times. But traditional approaches don’t always help when volatility, ambiguity, and complexity are off the charts.

What many leaders overlook in their rush to safety is that many of the most effective tools for managing risk come from an unexpected place: innovation.

The Counterintuitive Truth About Risk Management

Risk Management’s purpose isn’t to eliminate risks. It’s to proactively identify, plan for, and minimize risk. Innovation is inherently uncertain, so its tools are purpose-built to proactively identify, plan for, and minimize risk. They also help you gain clarity and act decisively—even in the most chaotic environments.

Here are just three of the many tools that successful companies use to find clarity in chaos.

Find the Root Cause

When performance dips, most leaders jump to fix symptoms. True risk management means digging deeper. Root cause analysis—particularly the “5 Whys”—helps uncover what’s really going on.

Toyota made this famous. In one case, a machine stopped working. The first “why” pointed to a blown fuse. The fifth “why” revealed a lack of maintenance systems. Solving that root issue prevented future breakdowns.

IBM reportedly used a similar approach to reduce customer churn. Pricing and product quality weren’t the problem—friction during onboarding was. After redesigning that experience, retention rose by 20%.

Focus on What You Can Actually Control

Trying to manage everything is a recipe for burnout. Better risk management starts by separating what you can control, what you can influence, and what you can only monitor. Then, allocate resources accordingly.

After 9/11, most airlines focused on uncontrollable external threats. Southwest Airlines doubled down on what they could control: operational efficiency, customer loyalty, and employee morale. They avoided layoffs and emerged stronger.

Unilever used a similar approach during the global supply chain crisis. Instead of obsessing over global shipping delays, they diversified suppliers and localized sourcing—reducing risk without driving up costs.

Attack Your “Deal Killer” Assumptions

Every plan is based on assumptions. Great risk management means identifying the ones that could sink your strategy—and testing them before you invest too much time or money.

Dropbox did this early on. Instead of building a full product, they made a simple video to test whether people wanted file-syncing software. They validated demand, secured funding, and avoided wasted development.

GE applied this logic in its FastWorks program. One product team tested their idea with a quick prototype. Customer feedback revealed a completely different need—saving the company millions in misdirected R&D.

Risk Management Needs Innovation’s Tools for a VUCA World

The best risk managers don’t just react to uncertainty—they prepare for it. These tools aren’t just for innovation—they’re practical, proven ways to reduce risk, respond faster, and make smarter decisions when the future feels murky.

What tools or strategies have helped you manage risk during uncertain times? I’d love to hear in the comments.

Start with a customer problem.

Know the difference between a problem that must be solved versus an inconvenience that should be tolerated.

Make a picture of the problem where the problem is between two things that touch each other and define it in time (when) so you can solve it before, during or after the problem occurs.

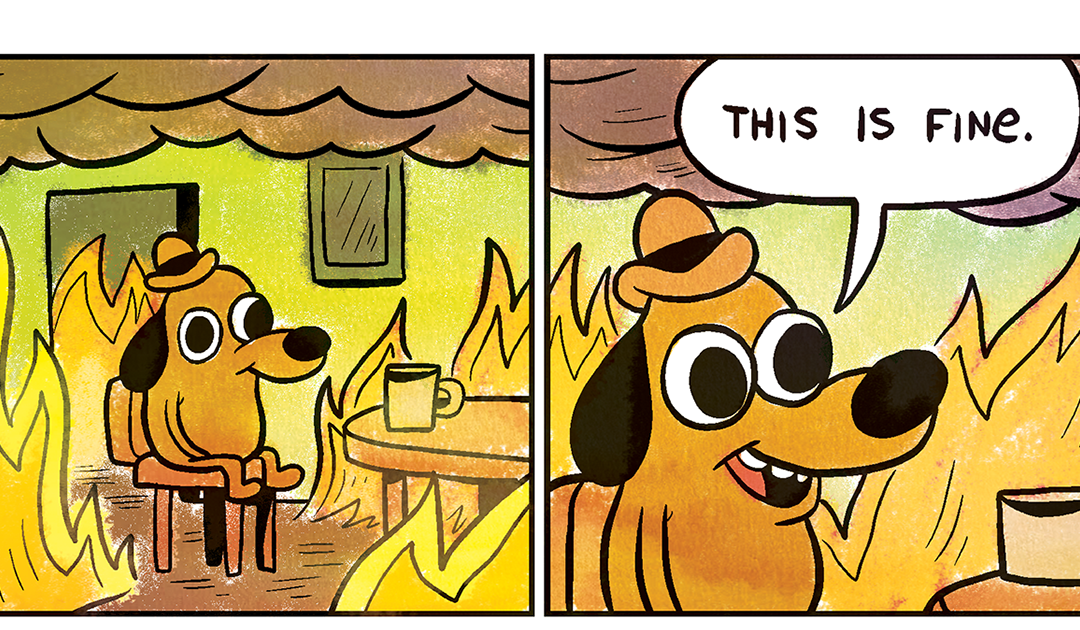

Great add, Mike. A picture truly is worth a thousand words – I’ve witnessed images, even simple hand-drawn pen and ink sketches, bring teams together to solve a problem faster and with more conviction than tens of thousands of words ever could. Thanks for the inspiration and advice on how to give it a try!